After the initial joy of finding out we will be parents, my husband and I sat down to start going over finances. We then began looking into my maternity leave options. Luckily, my employer allows me to take 6 weeks off at 60 percent pay. My husband and I decided that I will take the additional 6 weeks unpaid leave to make my leave a total of 12 weeks. This means we will be living for 12 weeks on a reduced income. We hear babies are expensive (hah) so we wanted to come up with a game plan sooner rather than later. This is what led us to the decision to do a Spending Freeze.

I don’t know why this terrifies me so much. The idea is so great sounding … the execution, not so much.

I got the idea from one of my dear friends to limit the amount of money we spend. She chose to limit her spending to only seven places:

- Publix

- Walgreens

- Target

- Vegetable co-op

- Gas

- Bill pay

- Home school field trips

Pretty amazing, right? She blogged about her struggles and her successes during her spending freeze. It is inspiring, to say the least. She literally only spent money at these places for 40 days.

I got to thinking … could we do this too? As it stands now, I’m six months pregnant and my grand plans of saving money for baby/maternity leave are now on display in our nursery and in memories of fast food dinners. Is it too late to make a change and try a spending freeze?

After sitting down with my husband, we have decided to try this out, but loosely. Second trimester energy proved to be a myth in my case so we will still treat ourselves here and there … just not every day. Is this cheating? Maybe. I’m only human, and I figure trying to follow some sort of plan is better than no plan at all.

There are several ways you can go about setting up a spending freeze. You can limit it to only shopping at certain places (like Publix, Target, Walgreens) and/or buying certain items (like gas, groceries, vegetable co-op). You can also just choose to do gas and groceries only for x amount of time, limit eating out to twice a month, so on and so forth. The point is to do something that CHALLENGES you (because let’s face it, we all need groceries, but do you really have to go once a week? Or can you plan better and use coupons or other money saving techniques to reduce the amount of trips you take and lower your grocery bill?).

Some guidelines we will follow are:

- Eating out less often. We added up what we spent eating out, whether it is a quick lunch during work or a dinner we are too lazy to cook for, and wow. We will focus on spending our money at the grocery store and do our best shopping sale items (BOGO for the win!).

- Avoiding stores like Target and Buy Buy Baby unless there are no other options. For us, we might as well hand over our wallets when we enter the door. There are just so many cute things that we

needwant.

- We will carry cash more, divided into different sections for gas, groceries, miscellaneous, eating out and entertainment. Once we run out of cash, we have hit our limit for the pay period for each section. No more cash? No more spending, sorry!

Basically, we want to keep our spending focused in the following areas/places:

- Bills (obviously … unless someone wants to take over this for us)

- Groceries (Publix)

- Gas

- Walgreens

- Extra money will go to our savings

- Some cheat meals here and there … and let’s be honest, some baby stuff here and there too. But only in moderation! And only if we have a coupon.

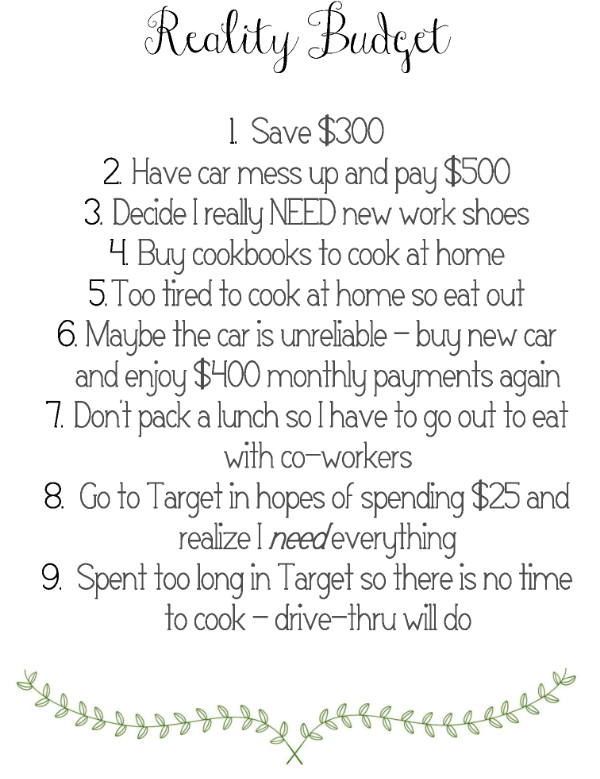

With this challenge I hope to gain patience, contentment (I’m bad about wanting something right then and there) and a sense of simplicity. I want to prove to myself that I can do it. Our main objective is to save for our extra cushion during my unpaid maternity leave. Just hoping throughout it all, our “reality budget” doesn’t end up looking like this instead…

We haven’t done a spending freeze per se, but more a year-long microscopic examination of everything in our budget. Started with figuring out what we were spending money on, then taking the biggest categories one by one and implementing changes. Cutting down on eating out was huge. I set up the things we regularly buy at Target on a subscription delivery plan – saves me both on the purchase price and from impulse buys. Then we cut down the grocery budget with help from the Budget Bytes website and Aldis. Switched our phone plan to Ting and cut our cell phone bill in half. Realized we were spending way too much on internet, and dropped to the lowest tier plan and bought our own modem instead of leasing. Cut the electric bill by changing the thermostat, opening windows more, turning off power strips we weren’t using, etc.

It’s been a slow process with a change or two each month, but I checked our budget from a year ago, and we’re spending about $600/month less as a family of four. What’s scary is that we barely even notice a difference, except that life now is less stressful. For example, now that I’ve got my go-to meals together, it’s actually faster and easier to throw together a burrito bowl, for example, then to figure out where we’re going to eat, drive there, pick something off the menu, etc.